If you re a new york state resident interested in filing for a renewable energy tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing.

Nys solar tax credit business.

New york state offers several new york city income tax credits that can reduce the amount of new york city income tax you owe.

Are you a full or part year new york city resident.

In addition to incentive and financing options your business may qualify for federal and or new york state tax credits and rebates for getting solar.

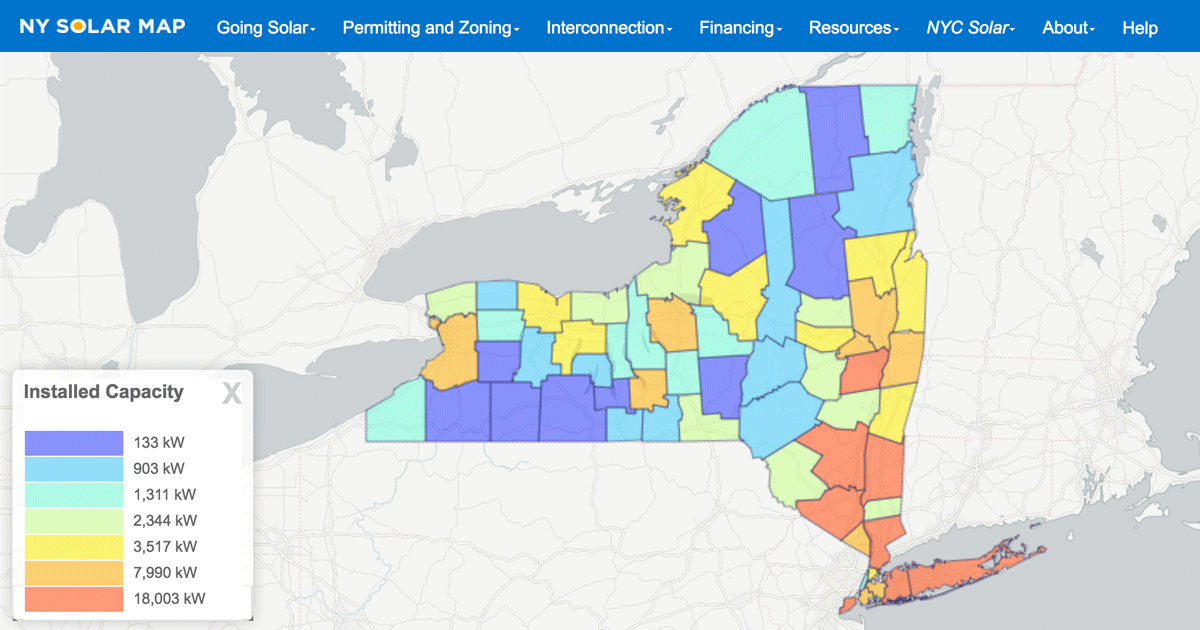

Expanding access and the opportunity to participate in community solar projects for all new yorkers ny sun is a major component of governor andrew m.

When pairing energy storage and solar you may be eligible for an energy storage incentive in addition to the current ny sun solar incentive.

The owner of a qualified solar installation can file for federal tax credits and accelerated depreciation on the cost of the installation.

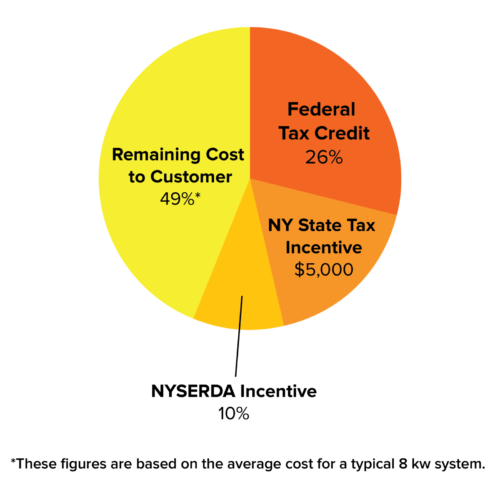

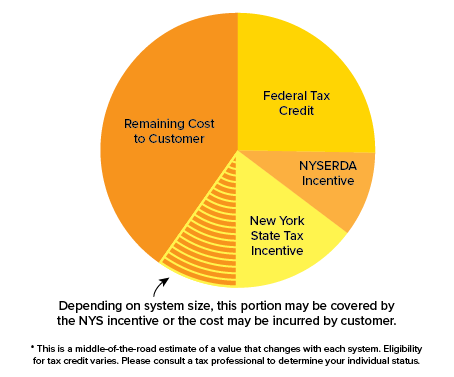

The new york solar tax credit can reduce your state tax payments by up to 5 000 or 25 off your total solar energy expenses whichever is lower.

The great advantages of the solar equipment tax credit are twofold.

New york city credits.

In addition to our incentive programs and financing options you may qualify for federal and or new york state tax credits for installing solar at home.

The solar energy system equipment credit is not refundable.

New businesses operate tax free for ten years and get access to state of the art facilities and fresh talent with start up ny.

The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000.

New york city property tax abatement pta.

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

Community solar for your home and business.

If you re a new york state business owner interested in filing for a tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing.

It applies to you even if you went solar with a lease or.

First you don t have to purchase your system to claim the credit i e.

If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.

Building owners who place a grid connected solar energy system into service from january 1 2014 through january 1 2024 are eligible for a four year tax abatement of 5 per year of the installed cost of the system for 4 years total of 20.

Abatements are capped at 62 500 per year or.